34+ Extra money on mortgage calculator

The loan is secured on the borrowers property through a process. If you have better use for your money such as stocks bonds real estate business or other opportunities.

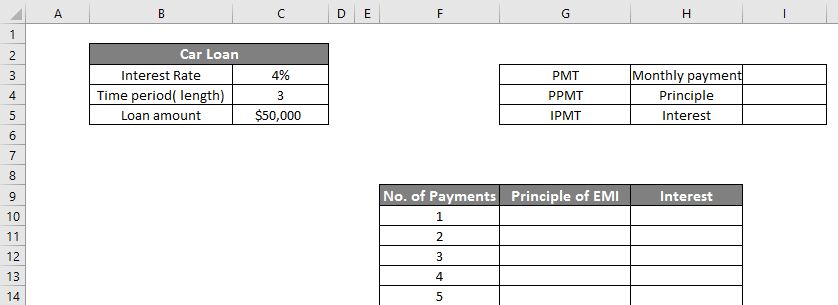

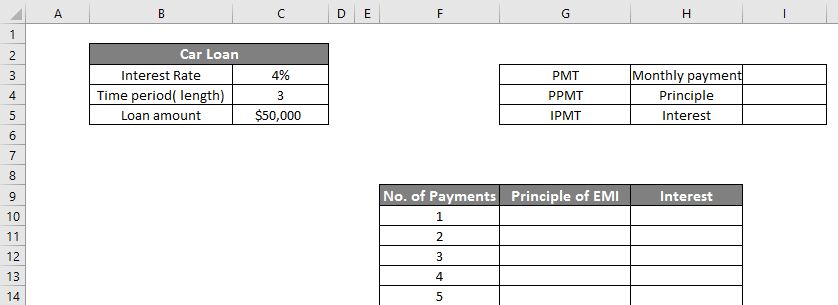

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

March 29 2020 at 234 pm Please i need a loan amortization excel sheet that has biweekly repayment.

. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. We offer an advanced mortgage payment calculator to figure monthhly housing expenses. Mortgage rates had dropped lower in 2012 when one week in November averaged 331 percent.

3 months 6. A standard ad that runs for eight weeks costs 3495 so it could be worth trying Gumtree or spare room first and marking your listing Monday to Friday only. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

A title for these calculator results that will help you identify it if you have printed out several versions of the calculator. Now that you know how to make extra money try a few of these or all 34 and see if you can generate a nice little chunk of change. If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time.

6 to 30 characters long. We also need to divide the interest rate by 100 to express the interest rate as a decimal instead of a percentage. Speak with a local lender to understand any extra costs associated with.

In this example if you apply for a mortgage with your spouse your front-end DTI ratio will be 2053 and your back-end DTI ratio will be 3417. Can you use the extra money for other better investments. Insurance and home maintenance to determine if you can afford the house.

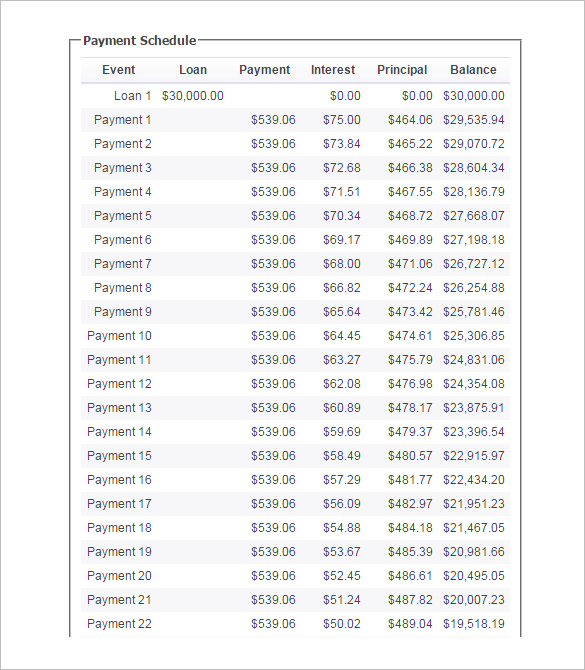

See how to make an amortization schedule in Excel to detail periodic payments on an amortizing loan or mortgage including an amortization schedule with extra payments and a variable number of periods. Over monthly payments is that biweekly payments allow them to pay off their mortgage earlier and hence save a lot of money on. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage.

Each point lowers the APR on the loan by 18 0125 to 14 of a percent 025 for the duration of the loan. It can be used for any type of loan like a car home motorcycle boat business personal student loan debt credit card debt etc. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

Must contain at least 4 different symbols. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. And when you start bringing home that extra money make sure youre using it to its max potentialby budgeting.

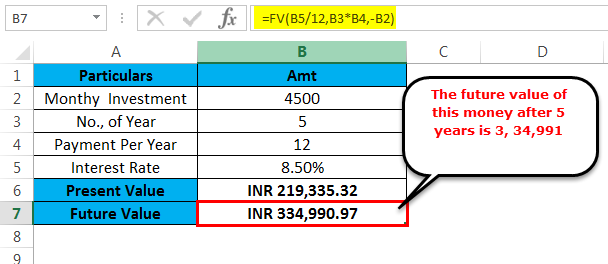

Our free budgeting tool EveryDollar will help you do just that. Step 2 - Calculate the monthly interest payment To calculate the monthly interest payment we will need to divide the annual interest rate by 12 as there are 12 months in a year. If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization. There are many opportunities to make extra money so try them out to supplement your income. The idea of a no-cost mortgage is misleading as you will be paying a higher interest rate over the life of the loan.

The Reserve Bank of Australia RBA has increased interest rates by 05 percentage points. Fixed-Rate Mortgage Discount Points. But some of 2012 was higher and the entire year averaged out at 365 for a 30-year mortgage.

The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66.

Fixed-rate mortgage interest rate and annual percentage rate APR For graduated-payment or stepped-rate mortgages use the ARM columns. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. That means the cash rate is now 135 per cent up from 085 per cent last month.

In all three examples the broker would not lose money even on the no-cost offer. Filters enable you to change the loan amount duration or loan type. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment.

Youre going to be working hard. Field Help Input Fields. Every month you delay benefits increases your checks slightly until you reach.

While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. Use this calculator to find the monthly payment of a loan. You can make extra money by filling in for Father Christmas or an elf in a grotto and as a bonus you get to put smiles on kids faces too.

By default 250000 30-yr fixed-rate loans are displayed in the table below. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. Though there is no upfront cost you will definitely feel the financial impact when you pay your mortgage for the rest of the term.

Get the latest stock market financial and business news from MarketWatch. The mortgage calculator with extra payments gives borrowers. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage.

An MMM-Recommended Bonus as of August 2021. Lock-in Redmonds Low 30-Year Mortgage Rates Today. How much money could you save.

ASCII characters only characters found on a standard US keyboard.

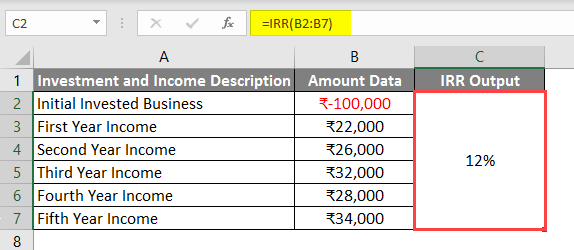

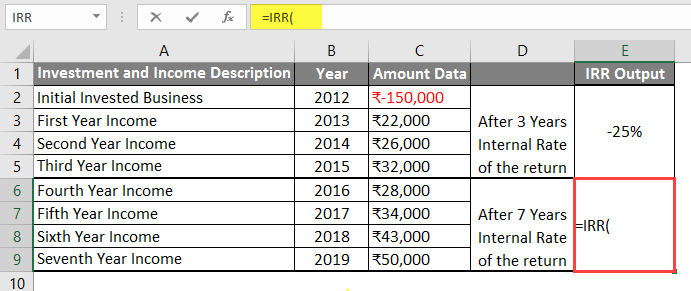

Excel Irr Formula How To Use Excel Irr Formula

Wf 9tucbh1kd8m

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

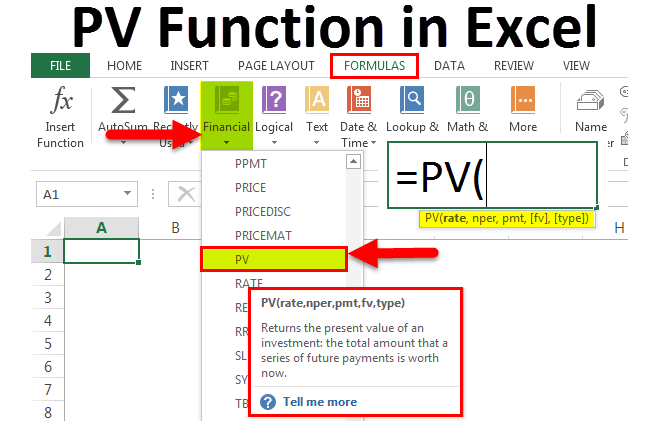

Pv Function In Excel Formula Examples How To Use Pv

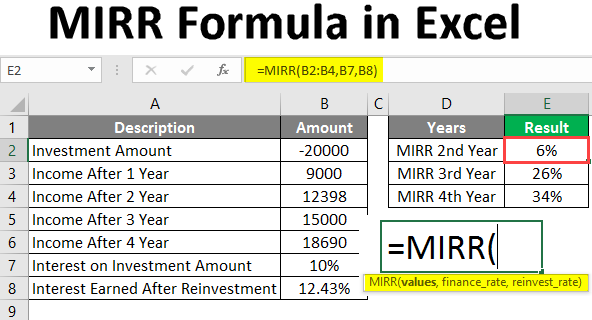

Mirr Formula In Excel How To Use Mirr Function With Examples

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Lot 34 Chinquapin Ln Morgan Hill Ca 95037 Mls Ml81884833 Redfin

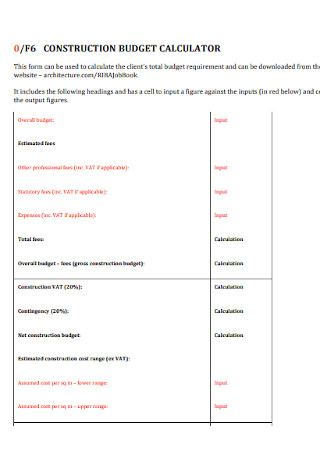

34 Sample Budget Calculators In Pdf Ms Word

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Irr Formula How To Use Excel Irr Formula

34 Sample Budget Calculators In Pdf Ms Word

Pv Function In Excel Formula Examples How To Use Pv

Calculate Compound Interest In Excel How To Calculate

34 Sample Budget Calculators In Pdf Ms Word

Lot 34 Chinquapin Ln Morgan Hill Ca 95037 Mls Ml81884833 Redfin

Excel Mortgage Calculator How To Calculate Loan Payments In Excel